Invest

Venture Strategy & Philosophy

Our foundation is built upon the following main core principles: Market knowledge, Integrity, No brainer deals, VREG Core Fundamentals, and Long-standing relationships. Each deal must meet our Investment Criteria and has to check off all the boxes before we do a deal. It’s better to pass on a good deal than to buy a bad one, as Dolf De Roos says, the long-time real estate investor and author.

Market Knowledge, we are deeply versed in the market, and take every step needed to ensure we know the market. We are consistently tracking data and talking with experts in their related fields daily. When we do rental valuations for instance, we will do them sometimes a dozen times during due diligence to ensure our data is correct, and there hasn’t been a change in the market.

Integrity is doing the right thing every time with no question. We will always make the right decision, no matter the cost. Our reputation is far more important than trying to hit numbers that aren’t real or doing a deal that we shouldn’t be doing because the numbers are inflated.

If there is any question on whether an opportunity is a great deal, we simply don’t do it. We have our strict core fundamentals we follow and our previously mentioned investment criteria. We acquire no brainer deals. These are opportunities that do arise and these are the deals we at Venture focus on and are committed to finding and executing at a high level.

Our success is derived from the extremely valuable relationships we have created and fostered over the years with our investors, clients, and vendors and is reflected through past testaments and continued results. We have established a foundation of trust that we don’t take lightly, as we continue to grow we want to see success with those who we’ve been in relationship with for years.

The Adriana 119-Unit

Address: 22524 7th Ave S Des Moines

Status: Current Project & Stabilized

Projected 5 year value: $25,531,914

Projected 7 Year IRR: 16.26%

Completed 2018, fully leased in 2019

When this site was located, Andy Langsford, President & Founder of Venture Real Estate Group, had a vision. This vision turned into what would be the ground-up development of a 119-unit senior apartment project that would help change the skyline of the growing downtown Des Moines, WA. Along with his business partner Brian Scalabrine, former NBA World Champion with the Boston Celtics, they began to bring this vision to life.

After assembling various land parcels in Downtown Des Moines, the project required multiple talks with the City of Des Moines to allow the development to reach its full potential including increasing the building’s height limit to reveal sweeping views of the Puget Sound from the Adriana’s roof-top deck, as well as reducing parking requirements which eliminated one level of underground parking, saving the project over $1M.

The building is fully completed, stabilized, and currently running at about 95-97% occupancy.

Arbol Grande

Address: 1420 Fones Rd SE, Olympia, WA 98501

Status: Closed and fully funded

Purchase Price: $7.35M

Rehab: $654K

Projected Value: $10.145M

Projected 4 Year Profit: $1.171M

Projected 4 Year IRR: 12%-15%

Property Highlights:

Excellent value add opportunity in the desirable Olympia/Lacey market

25-unit complex comprised entirely of large 2-bed units, with room to raise rents, and bring substantial value

Arbol Grande is a twenty-five unit apartment complex that was well built in 1994 on a 59,242 sqft (1.36 acres) lot. All units have a spacious floorplan making them easy to rent, with the ability to be marketed as luxury apartments post-renovations. We are turning the current office into a studio apartment which will generate additional income, and will turn this project into a 26-unit property.

University Place Apartments

Address: University Place, WA

Status: Recently under contract but backed out

Purchase Price: $11.8M

Project Type: Ground-up construction

Projected 7 Year Value: $150.7M

Projected 7 Year IRR: NDA required

Property Highlights:

Major 377-unit mixed use development project in University Place, WA

Ground up construction of residential units and retail space

The University Place apartments were to be built on a largely undeveloped Light Industrial zoned area of University Place, WA. This project consisted of developing a 7+ acre lot in a prime location, adjacent to a private golf course. Six separate buildings were proposed which would house a total of 377 units. The first floor of the front building was reserved for retail occupancy.

More Photos from The Adriana

Rooftop Deck

Model Living Room

Model Kitchen

Model Bedroom

The Andover Apartments

4000 California Ave SW Seattle, WA 98116

Exterior Before Remodel

Exterior After Remodel

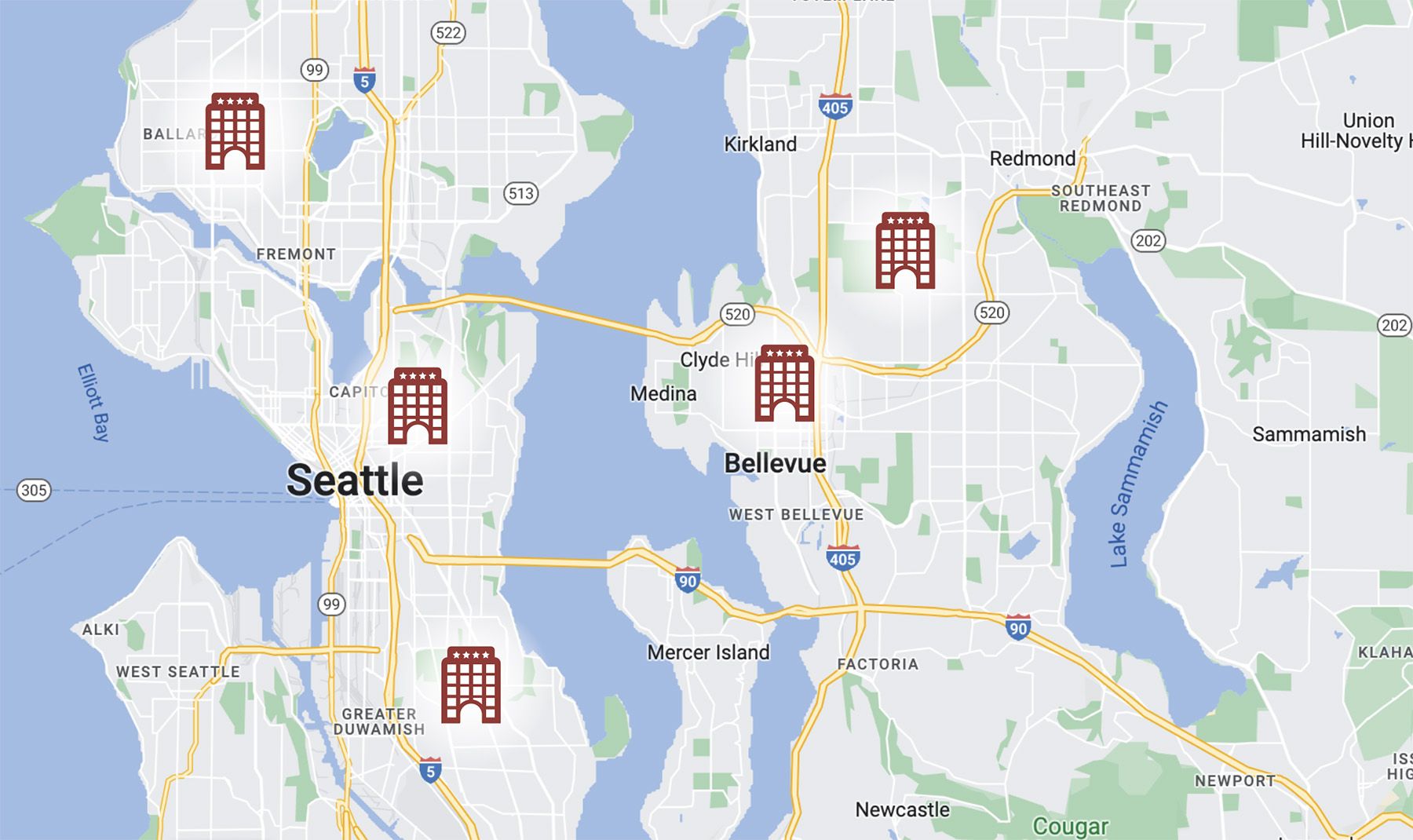

$450M Development & Hotel Portfolio

We recently were very close to acquiring a $450M development and hotel portfolio consisting of over 1,000 keys and the ability to repurpose a few of the sites and develop multifamily midrise and highrise sites throughout the Northwest. Our capital partner and Andy Langsford had multiple meetings with the ownership group, board members, and at this point have not come to an agreement on the terms of the transaction. We have learned to be patient.